Davos 2024: India Wins

Politics dominated discussions at Davos this year as anxiety over armed conflicts, trade wars, and polarization eclipsed economic debate. The takeaway for supply chain leaders is to lean into the regionalization of value chains, with India a top beneficiary.

The WEF’s annual meeting of world leaders closed last week on a schizophrenic mix of hope and fear. Economics was less of an issue than politics, with charged positions from the right (notably, Argentinian President Javier Milei) crashing hard against classical ideals of global integration as the inevitable end for an enlightened world. IMF Deputy Director Gita Gopinath crystallized this outlook, lamenting, “Fragmentation is a reality, it’s not just a threat.”

For supply chain leaders, the biggest takeaway is simple: bet on India.

Regionalize or Struggle

Economists and heads of state seem to finally realize that “global trade” has passed an inflection point and low-cost labor is no longer the dominant comparative advantage of developing countries. Supply networks built by global companies like Cisco, Schneider Electric, and ABInBev have been regionalized for decades because the business benefits of customer and market proximity often outweigh cost savings on labor.

Anxiety over surging armed conflicts, on-again-off-again trade wars with China, and the possibility of a second Trump presidency has leaders like Christine Lagarde of the European Central Bank leaning into fragmentation. “The best defense, if that’s the way we want to look at it, is attack,” said Lagarde, by which she meant shoring up the internal economic capabilities of the EU’s home market.

Germany is now learning to live without Russian gas, while the US is ramping up semiconductor and renewable energy independence, and China is deepening ties with Brazil for raw materials. The future of “global” supply chains is a patchwork of production cells built for speed and resilience that enables business to ramp up or down as opportunities emerge and often just as quickly recede.

Why, when, and how to invest in physical assets will increasingly be a matter of regional or even local market conditions that shift in response to political, social, and cultural forces. Forecasting such things isn’t supply chain management’s sweet spot; engineering for it, however, is.

The New Middle Kingdom

China’s twenty-year climb to its current dominance as factory to the world aligns with its historical self-image as the “Middle Kingdom.” Having earned global preeminence in manufacturing technology at every tier of supply chain and, in the process, built massive consumer demand that sustained growth for brands everywhere, it seemed inevitable that China would own the future.

And yet, demographics, geopolitics, and now technology talent have shifted the center of our economic future 3,000 miles southwestward to India. McKinsey’s research on the geometry of global trade finds that this newfound centrality is multi-faceted: “India sits toward the global average across dimensions. This reflects its broad trade relationships with Asia, Europe, and the United States, which also support relatively diversified import relationships.” Geographically, politically, and in terms of how far upstream or downstream in the value chain (ie, supplier or customer), India sits squarely in the middle of everyone’s plans. Their presence in Davos was ubiquitous and upbeat.

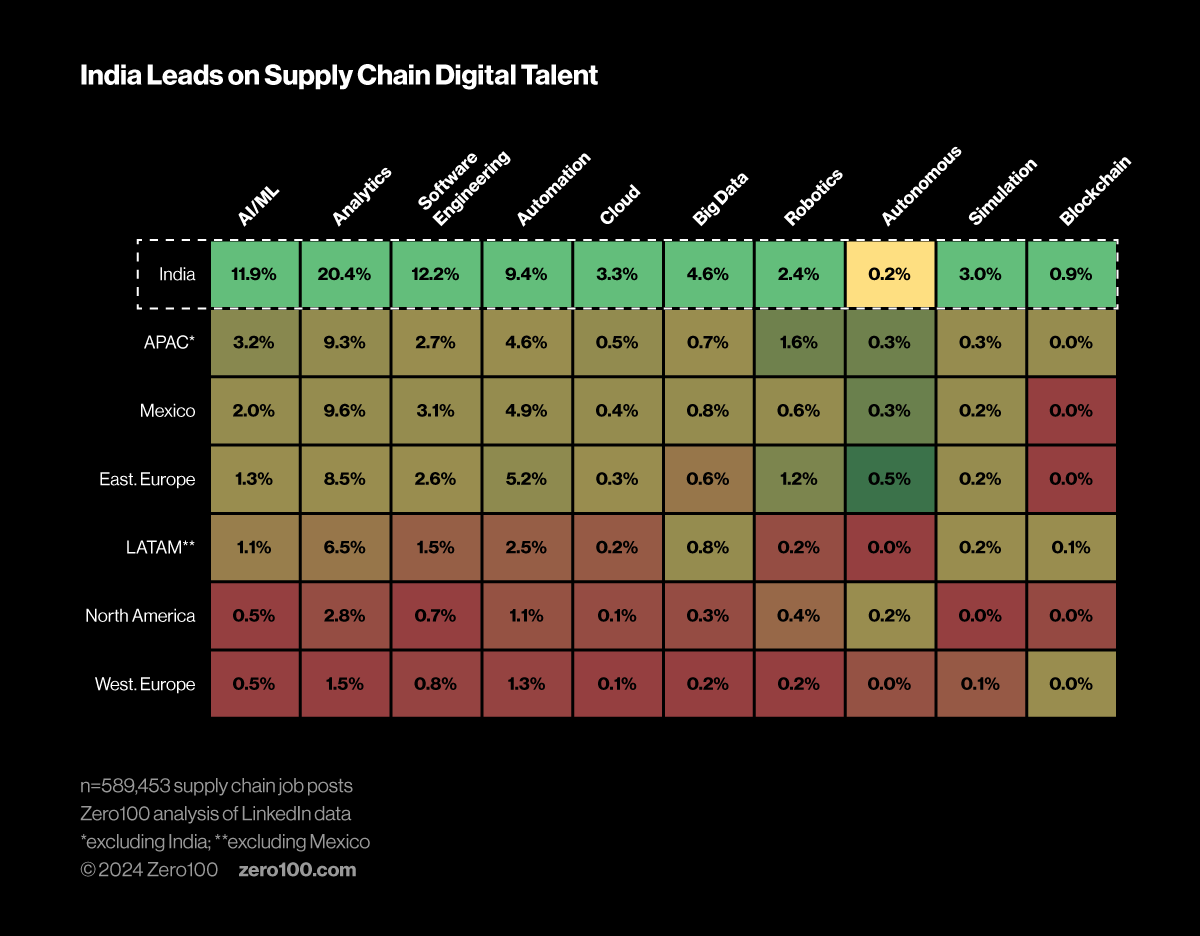

Perhaps most important, though, is India’s young, growing, and technically sophisticated workforce. Having invested early and heavily in premium, merit-based higher education, the country now boasts the most digitally savvy supply chain talent pool in the world. Zero100 analysis of specific digital skills in LinkedIn job posts shows India to be dramatically ahead in nearly all categories of specialized digital skills.

It's Not Too Late, but It Is Time to Move

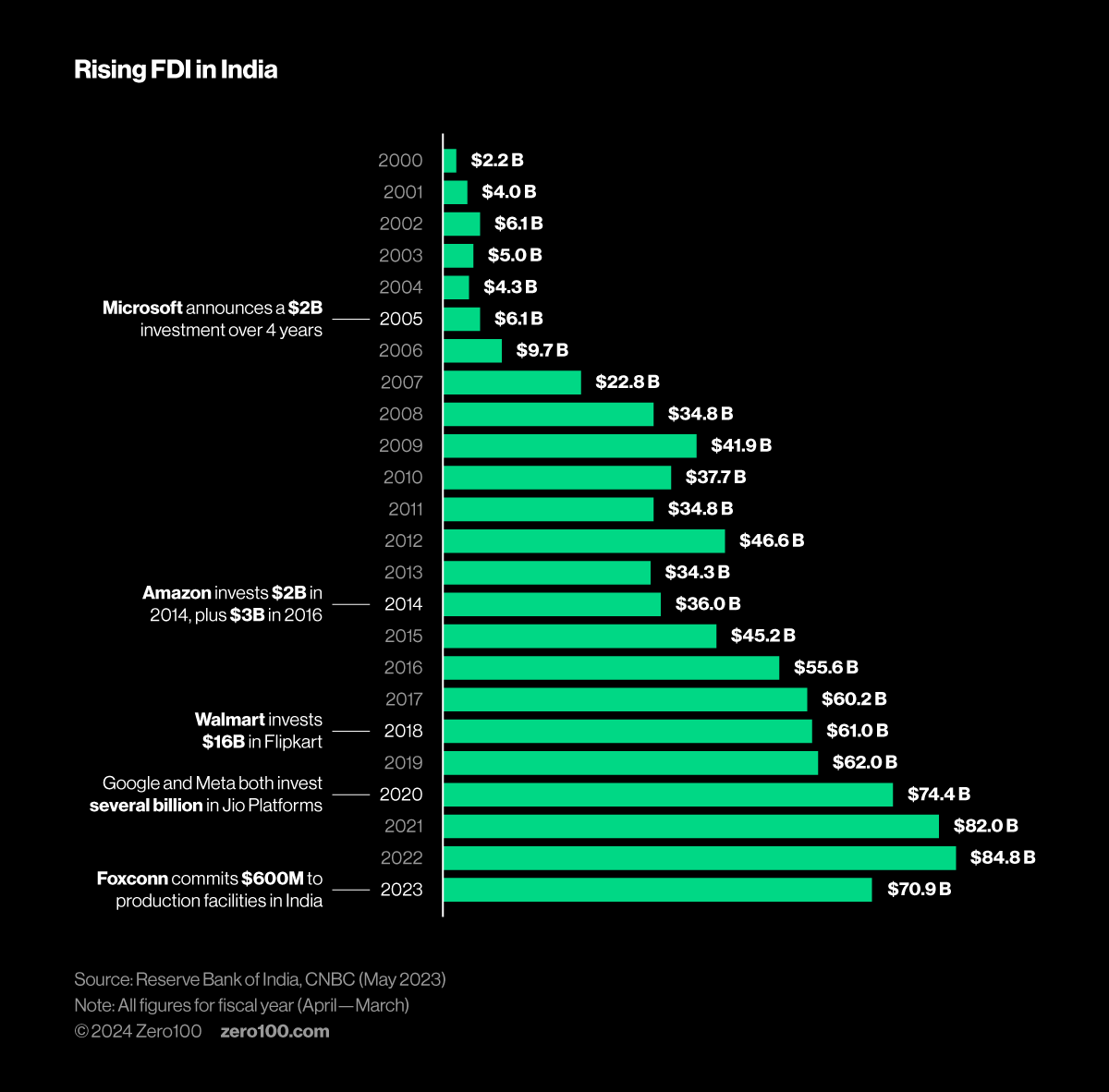

For supply chain leaders, much of this is already well known. In fact, data on foreign direct investment in India shows a steep rise over the past twenty years, led by heavyweights like Walmart, Amazon, Foxconn, and Microsoft. The stressed political vibe in Davos suggests that smart money will follow this flow.

If the resulting surge in business enriches the world’s most populated country as logic suggests it should, this virtuous circle could turn into a serious flywheel. And for those who remember China’s early days on the push into scaling its export economy, hesitation could be a mistake.

Everyone’s Friend

The traditional great powers came off looking dazed and confused last week. Rivalry, jealousy, and self-doubt are driving the dynamics between the US, Europe, and China.

India, meanwhile, sits calmly in the center, ready to work with everyone.

Well played.