UPS’ recent agreement with the Teamsters Union has driver compensation set to reach $170,000 per year, on average, in salary and benefits. The popular story is about wage pressures and inflation, which the Fed insists still requires more interest rate hikes, but this misses the bigger point.

This deal could mean the end of the perennial “truck driver shortage” and the rise of a new kind of logistics career that stretches from early adulthood through retirement with enough growth, learning, and money to attract plenty of ambitious young people to apply. It will also probably pay for itself with innovation driving labor productivity gains.

Labor and Capital Get Married

Supply chain, more than other functional departments like finance, HR, or sales, hires many people without college degrees or formal certifications. As a cost center, supply chain has always tried to hire cheaply, but recent advances in technology have started to change that. More and better digital controls on machinery, including delivery vehicles, have started to increase output per worker. ROI thresholds on capital investments are getting easier to clear with the tech improving while labor costs are increasing.

UPS’ deal may lift all boats in a rising tide of productivity that could usher in an era of growth decoupled from inflation thanks to a well-funded boom in technology and infrastructure investment. This has happened before. In 1914, the Ford Motor Company doubled its plant workers’ daily wage to five dollars per day and went on to build millions of Model Ts.

The equation worked then because labor and capital providers both won. Together, they delivered a transformative industrial boom. Absent the cheap capital bonanza that floated ecommerce’s early adventures, this new phase looks like labor getting its due, while capital insists on efficiency gains in return.

You Get What You Pay For

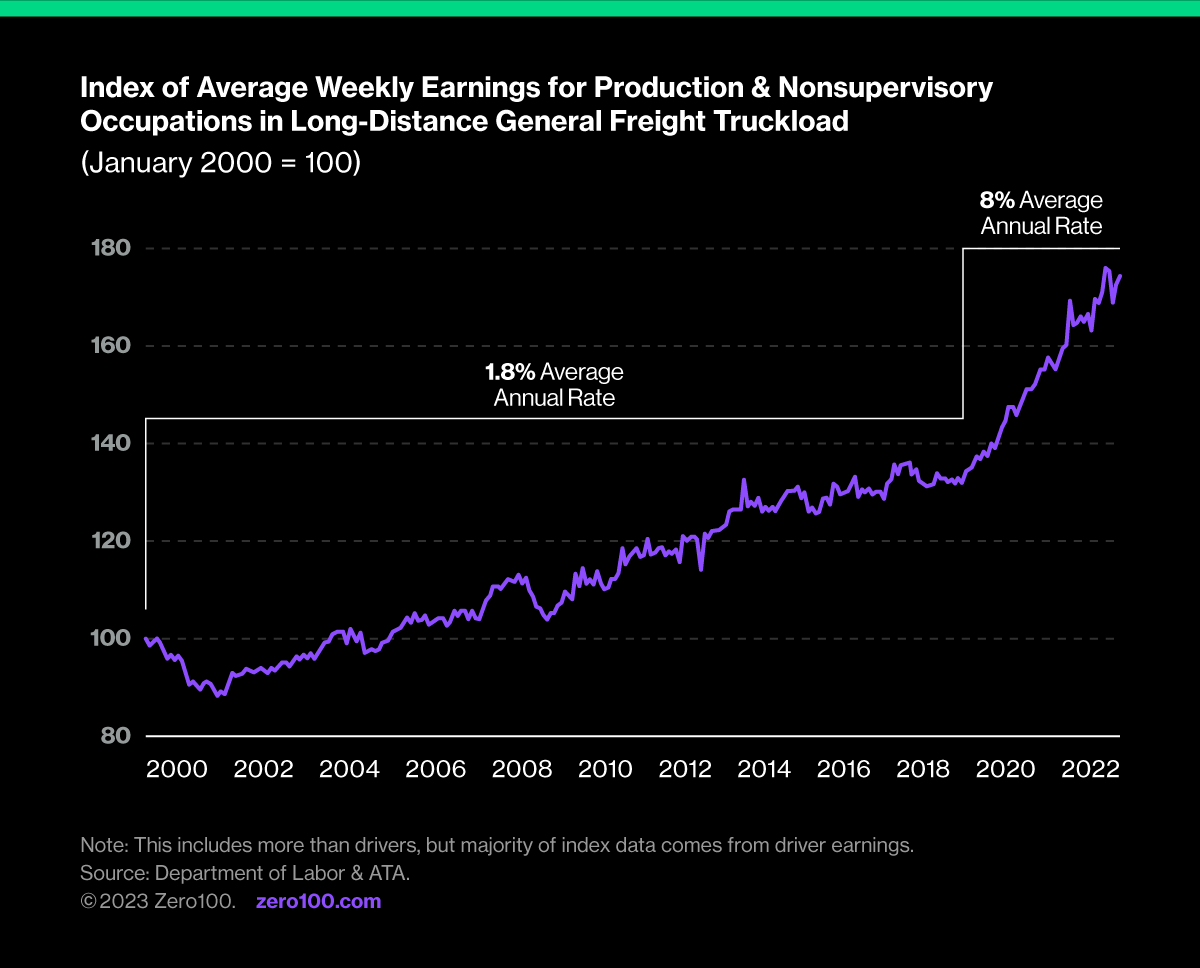

I’ve been writing about supply chain for 25 years, and the “truck driver shortage” has been around for so long that it’s practically a meme. Serious-sounding people debate the reasons without ever facing the truth – the role has been underpaid and held in low regard, which means it doesn’t draw enough jobseekers. Turnover in some of these local loop delivery businesses is over 100% annually, and although the public did a nice job of celebrating our heroic “essential workers” through COVID, it took the threat of a strike to deliver real money.

$170,000 may sound like a lot, but it will be worth it. Success in parcel logistics depends on dozens of constantly shifting variables like weather, order volumes, and special drop requests, all of which interact in unpredictable ways. It is an extraordinarily complex, perpetual non-stochastic optimization problem that toggles between an irate customer missing an important delivery and the rare serenity of a perfect route.

One of the key controllable factors is driver experience. Adding capital investment to digital systems that support the driver, delivery station teams, and even the customer will improve flexibility and troubleshooting in real-time, but without an experienced driver able and willing to apply judgment, it won’t work well. There are simply too many subtle failure points when each delivery is made.

What About Inflation?

UPS’ stock took a hit with this news because its EPS estimates dropped. The costs will initially be passed on to customers. But there is something different about the idea of wage-price spirals dooming us to stagflation. The Fed, along with most economists, seem to be underestimating the power of customer choice today. In the 1970s, when stagflation made its name, there was no e-commerce or omnichannel, no way to work from home, no endless selection of items on sale 24 hours a day. UPS will need to keep inventing (or else customers will dry up), and that is good news for everyone.

This deal is exciting because it lays the groundwork for an ecosystem of ever-evolving parcel delivery capabilities that could include drones or AGVs, multi-purpose hubs and retail sites, or even completely new approaches to packaging and returns. The possibilities are endless, but without experienced drivers, some will fail unnecessarily, while others will never be discovered.

The heroic COVID delivery drivers of 2020 are an engine of future logistics innovation.