Amazon & Shein: The Next Great Supply Chain Redirect?

Amazon faces an unprecedented threat from a new class of Chinese manufacturer-brands who leverage hyper-flexible, digital-first supply networks to launch as many as 6,000 new styles daily at 75%+ off list price. The innovation is exceptional, but so is the downstream waste. We need to harness the breakthrough but also redirect for resilience.

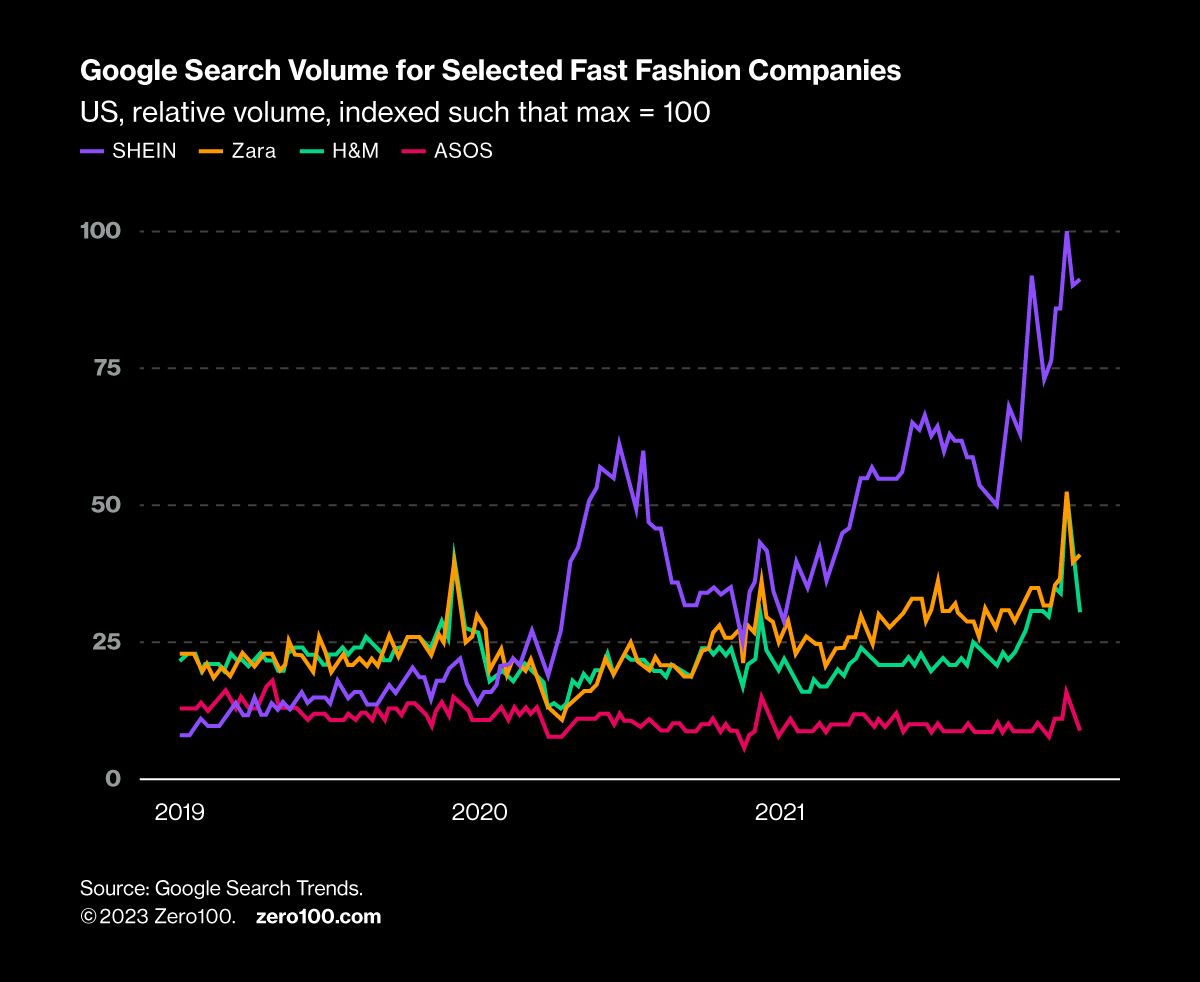

Amazon’s supply chain advantage is under accelerating threat. Upstart manufacturer-retailers like Shein are mixing supply network mastery with TikTok virality to leapfrog Amazon’s deep and coveted relationship with the US retail consumer.

Shein’s growth formula is fast fashion at its core, only more so. The company uses a digitally native low-cost China supplier platform to launch an eye-watering 6,000 new products per day (as compared to Zara’s 2,000 styles per month) and sell at prices a full 70% lower than comparable products on Amazon. Shein has since recruited over 3,000 Amazon sellers to its platform to diversify its offering beyond apparel. The combination is explosive.

From 2017 through to the first half of 2023, Shein revenues grew 20x, from $1.5 billion to $40 billion, surpassing Amazon as the single most downloaded shopping app in the US while racing past Zara for the overall number one spot in US fast fashion.

No wonder Wall Street is concerned. The playbook for e-retail hegemony just got far more complex. The capability set for Amazon’s last-mile speed and convenience is, in some ways, the polar opposite of Shein’s formula for novelty on the cheap.

Shein, in turn, will need to confront its own stakeholder criticism. Fast fashion is under an ever-harsher spotlight for its real and perceived environmental and human rights abuses. The key is to study, with humility, what’s good about Shein’s supply chain innovation and harness it.

A Supply Chain Breakthrough…

The key to Shein’s supply chain is its digital first reimagination of a network-wide business process. The company is a multi-tier, digitally native platform that leverages algorithmic demand sensing to precision-orchestrate lean product flow through a keiretsu of Chinese developers and suppliers. Behind the scenes is a custom, cloud-native, and unified PLM planning and execution platform, with product and supply network decisions auto-guided by AI/ML-driven forecasting algorithms, digital twin simulation, and exception-based workflows. The result is inventory that turns every 30 days (vs the industry average of four times per year), a weekly supplier order-to-pay cycle (vs every 60-90 days), and minimums of 150 units (vs 1,000+ unit average). From a purely operational perspective, Shein is an example (albeit a controversial one) of what we at Zero100 call Regenerative Business Planning (RBP), the adaptive, integrative, self-learning form of S&OP.

Shein’s supply chain breakthrough also drives one very real environmental benefit: By producing to demand, the company produces less than 2% unsold inventory (vs the industry average of 30%). Avoiding over-production is a very real contribution to decarbonization.

…Or Not

However, the evidence that Shein’s business model is an environmental time bomb, one that will either fold or shrink in the face of intensifying consumer and regulatory blowback, is equally compelling. Fast fashion, by most measures, is four times more net carbon intensive than conventional apparel, driven by the shorter lifespan of the lower-grade construction required to keep prices so low. Shein is also closed-lipped about the working conditions required to produce everyday cut-rate prices. And consumers are noticing the opacity, not liking what they don’t see.

Per The Fashion Transparency Index, Shein has a trust score of 7%. Though not known for leading with sustainability, Amazon scores nearly five times better at 29%. And we now know with increasing precision the monetary value of the difference: In a recent HBR article, trust analytics specialist TrustID reported that transparency drives up relative purchase intent by as much as 400%, and each point of trust amounts to a 3-6% improvement in stock price.

By this measure, Shein’s legendary first wave could just as easily crash as fast as it rose.

The Great Redirect

But it would be a mistake to jettison the learning. Just as Amazon reinvented the standard for customer centricity almost 30 years ago, Shein may have just quietly cracked the code on end-to-end flow. The key is to listen, borrow, and redirect the innovation energy in the direction of resilience. Consider:

- Danone decisively stepped away from manual processes at a factory network spanning 120 countries, deploying a suite of 20 tools ranging from advanced robotics, AI-based planning and scheduling, and threaded collaboration to cut production costs by 19%, reduce energy consumption by 40%, and cut greenhouse gas emissions by 50%.

- The CEO of PepsiCo sponsored an end-to-end reset of the company’s Integrated Business Planning (IBP) process, integrating risk-weighted carbon metrics alongside cash and cost KPIs to embed carbon in core inventory and product portfolio tradeoffs while beating quarter-over-quarter EPS forecasts for two years running.

- Furniture retailer IKEA reinvented its US fulfill-by-store initiative for circularity, adding a used product takeback service across its network of 54 US megastores, expanding its cross-channel service suite to include takeback, repair, and resale. On Black Friday in 2022 alone, the company took back and resold over 100,000 items.

Shein, too, is not standing still on the matter of waste. In May 2023, the company publicly committed to reducing greenhouse gas emissions by 25% by 2030 and achieving full circularity by 2050, engaging in MIT-backed digital materials exchange Materia MX to replace new materials with overstock from other brands, and setting in motion its own in-app resale marketplace.

Will these moves and further commitments be enough for Shein to survive the stakeholder onslaught? Will Amazon respond to this new class of China-based digital disruptors with a supply-side rewrite of its own? What’s clear is we need to watch and absorb in order to win.