Climate Bill: 5 Impacts on Supply Chains

Supply chain professionals are working hard to transition from fossil fuels to green energy. The climate bill passed by the US Senate last week offers renewed support to speed up decarbonizing supply chains.

On August 7th, following months of heated negotiations, the US Senate passed a $750B climate, tax, and healthcare package – the Inflation Reduction Act. The legislation fulfills Democrat party goals including lowering the cost of prescription drugs, making the tax code more equitable, and investing in the fight against climate change.

Over the next 10 years, the bill allocates nearly $400B to tax credits designed to incentivize a major shift to electric power, qualifying it as the largest single investment made to slow global warming in the US. Princeton ZERO Lab predicts that these new measures could make it possible for the US to cut GHG emissions about 40% below 2005 levels by 2030.

This surge of resources and support is coming at a time when many organizations are struggling to turn climate promises into reality. When you consider that for most organizations, 90% of emissions come from their supply chain, it's evident that supply chain professionals have a vital mission ahead of them.

Here are 5 ways the bill helps accelerate your move to a zero percent carbon supply chain:

1. Eliminate the number one barrier to your energy transition: funding.

Supply chains have the opportunity to make a major dent in two of the largest shares of total GHG emissions in the US: transportation (37%) and industrial (28%).

Many have made strides in doing so already. The Estée Lauder Companies source 100% renewable electricity across their operations, Sephora has achieved 100% renewable energy across US-based stores, corporate offices and distribution centers, and Church & Dwight has offset more than 70% of CO2 emissions, striving for 100% by 2025.

But building the infrastructure necessary to fully switch to green energy in the next decade is expensive – with an estimated cost of $4.5T. $30B of the tax credits will help pay for the production of solar panels, wind turbines, and batteries, solving for one of the largest obstacles of all: funding the new infrastructure.

2. Invest in tech to stem, rather than mitigate, crises.

New corporate tax increases will raise $70B over 10 years, funds the US government is allocating to thwart climate change. As soon as 2027, the new credits and incentives for low emission energy sources will outweigh a new minimum tax on some large corporations, resulting in a yearly corporate tax cut.

The money paid in taxes now will ultimately limit the time and money supply chains spend mitigating climate related disasters in the future, which last year cost the US nearly $100B. It also offers an incentive to develop and implement crucial technologies, such as AI and machine learning, robotics and automation, 3D printing, IoT and blockchain.

3. Explore experimental methods with financial backing.

$10B has been allotted to developing technologies such as carbon capture and sequestration, hydrogen, and small nuclear reactors. $500M is designated for heat pumps and critical minerals processing. A $1500 per ton fee would be applied to oil and gas companies to address excess leaks of methane, a 10-year moratorium on offshore wind leasing will be undone, and fossil fuel and drilling provisions will be enacted – further motivation for supply chains to experiment with alternate solutions.

4. Improve your ESG impact by embracing a more equitable landscape.

$60B of the bill is dedicated to helping areas disproportionately affected by climate change – an incentive for any supply chain leaning in to improve their ESG impacts. A portion of this sum is dedicated to the creation of the first national “green bank,” which will serve as a fund to drive investments in clean energy projects, especially in poor communities.

5. Bring sourcing closer to home.

To qualify for the extended credit offered to electric vehicle manufacturers, 40% of battery components must come from factories in the US or its free trade agreement partners. By 2029, 100% of all batteries must be made in the US. By 2024, all Chinese components and minerals must be phased out.

Many supply chains have been experimenting with nearshoring, onshoring, friendshoring as a way to circumvent operational obstacles and geopolitical instability – and should use this as motivation to continue pushing ahead.

How Does This Compare to the EU's Ambitions?

The EU has pledged at least 55% fewer GHG emissions by 2030 through the imposition of binding emissions targets across key economic sectors. In July 2021, the Council and the Parliament reached an agreement making the 2030 emissions reduction target a law – the European Climate Law. To be the first climate-neutral continent, the EU enacted the European Green Deal, which allots 600B toward boosting the efficient use of resources by moving to a clean circular economy.

In combination with last year's bipartisan infrastructure package, the US's spending on climate change is on track to match up with the EU's climate budget.

A Push Towards the Finish Line

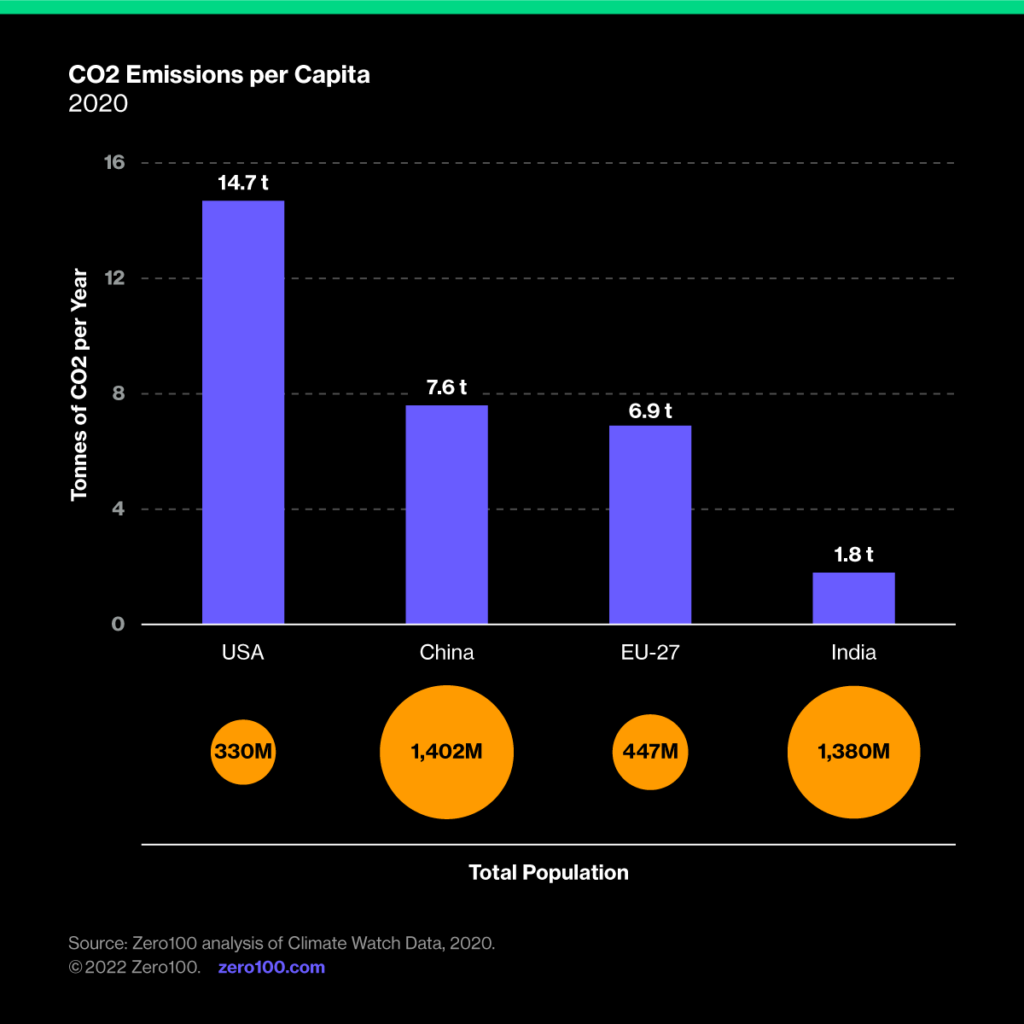

After China, the US is the world's biggest carbon emitter. But the carbon emission targets set by supply chains are falling short. The Inflation Reduction Act puts the US at the forefront of countries taking concrete action against climate change, setting us on track to accomplish results at scale. Now it's up to us to make the most of it.